Crypto Futures, Leverage, and Liquidation in 2026: A Professional Playbook for a Mature Market

A New Phase for Crypto Derivatives

By 2026, cryptocurrency derivatives have shifted from a speculative niche into a core component of the global financial system, with futures and leveraged products now embedded in the risk management and trading frameworks of institutions across North America, Europe, and Asia-Pacific. Daily derivatives volumes routinely outpace spot markets on leading venues such as Binance, Bybit, and OKX, and the tools once reserved for specialist desks-high leverage, perpetual swaps, algorithmic execution-are available to a global retail audience trading around the clock. For readers of tradeprofession.com, this evolution is not simply about new instruments; it is about understanding how these products reshape risk, capital allocation, and strategic decision-making in an increasingly interconnected financial landscape.

The rise of crypto futures has coincided with the rapid expansion of artificial intelligence in trading, the normalization of digital assets in banking and investment products, and the tightening of regulatory frameworks in jurisdictions from the United States and United Kingdom to Singapore and Japan. Against this backdrop, liquidation risk has emerged as a central concern. Leverage can accelerate portfolio growth, but it can also erase capital in seconds when volatility spikes. Executives, founders, asset managers, and analysts now recognize that literacy in derivatives is no longer optional; it is a core competency. Readers seeking broader context on this transformation can explore the evolving role of technology in finance via TradeProfession's technology insights.

The Evolution of Crypto Futures: From Experiment to Infrastructure

Crypto futures began as an experiment in price discovery and hedging, but they have matured into a global infrastructure layer for digital assets. The launch of Bitcoin futures on the CME Group in 2017 marked the first major bridge between traditional finance and crypto, followed by innovations such as perpetual swaps on BitMEX, which introduced a contract design uniquely suited to 24/7 markets. Over the past decade, this infrastructure has diversified to include physically settled contracts, options, and structured products offered by regulated platforms like CME, Kraken, and Coinbase Derivatives, as well as offshore exchanges targeting global participants.

By 2025, derivatives volumes frequently exceeded 150-200 billion dollars per day, powered by a combination of institutional hedging flows, retail speculation, and quantitative strategies. This growth has been reinforced by the integration of crypto derivatives into multi-asset portfolios, where they are used alongside equity, FX, and commodities futures to manage macro exposure. For a more holistic view of how derivatives intersect with traditional markets, readers can review macroeconomic perspectives at TradeProfession's economy section. What differentiates crypto from legacy asset classes is not just the instruments themselves, but the speed, transparency, and global accessibility with which they are traded.

Futures in Cryptocurrency: Design, Purpose, and Market Function

A cryptocurrency futures contract is, in principle, similar to its traditional counterpart: an agreement to buy or sell an asset at a predetermined price at a future time. In practice, however, crypto markets have introduced several innovations that have become industry standards. The most significant is the perpetual futures contract, or perpetual swap, which has no expiry date and is instead anchored to the spot market through a funding rate mechanism. Exchanges such as Binance Futures, Deribit, and OKX now offer a broad suite of linear (stablecoin-margined) and inverse (coin-margined) contracts on major assets including Bitcoin, Ethereum, and leading altcoins.

Perpetual futures have become the default instrument for both short-term traders and longer-term hedgers because they avoid the operational complexity of rolling expiring contracts, yet still enable leverage and short exposure. Market participants in New York, London, Frankfurt, Singapore, and Sydney now routinely incorporate these contracts into multi-venue strategies that arbitrage price discrepancies, manage basis trades, or hedge spot holdings. Readers seeking a focused overview of digital asset markets can refer to TradeProfession's coverage of crypto, where derivatives are treated as an integral component of the asset class rather than a speculative add-on.

Leverage: Power, Precision, and the Margin Constraint

Leverage remains the most potent-and misunderstood-feature of crypto futures trading. By posting a fraction of a position's notional value as margin, traders can control exposure many times larger than their capital base. In practice, this means that a 5 percent move in the underlying asset can translate into a 50 percent gain or loss on equity when using 10x leverage, and complete liquidation at more aggressive levels such as 25x or 50x. On platforms where leverage up to 100x is still available for professional or non-retail accounts, the margin for error is measured in fractions of a percentage point.

The logic is straightforward: leverage multiplies both potential returns and drawdowns, and the maintenance margin threshold acts as the boundary between active risk-taking and forced liquidation. Once equity falls below this threshold, the exchange's risk engine intervenes to close the position, not to punish the trader but to protect the solvency of the platform and its counterparties. In a market where Bitcoin can move several percent in minutes and smaller-cap assets can swing double digits within hours, leverage transforms normal volatility into existential risk. For professionals designing allocation frameworks, TradeProfession's investment analysis provides a useful lens on how leverage should be treated as a strategic tool rather than a speculative shortcut.

Liquidation: The Critical Threshold in Leveraged Markets

Liquidation is the mechanical outcome of a simple equation: when the value of a trader's position plus remaining margin is no longer sufficient to meet maintenance requirements, the exchange must assume control of that position and close it into the market. While each platform uses its own formulas and risk parameters, the principle is universal. The liquidation price is a function of entry price, leverage, fees, and maintenance margin rates. At high leverage, even modest price moves can push the mark price to this boundary.

Consider a 50x leveraged long position on Bitcoin: a move of roughly 2 percent against the position can exhaust initial margin, particularly once fees and funding are considered. When markets are calm, traders may underestimate this sensitivity; when volatility spikes, as during the 2024 Bitcoin drawdowns or sharp regulatory announcements in the United States and Europe, liquidation engines can trigger billions of dollars in forced selling or buying within hours. This dynamic is not merely a retail phenomenon; institutional desks using leverage for basis trades or yield enhancement are equally subject to these thresholds. For professionals interested in the quantitative side of market structure, resources from organizations such as the Bank for International Settlements and the International Monetary Fund offer useful background on derivatives-driven volatility, complementing the practical coverage at TradeProfession's stock exchange section.

Perpetual Futures, Funding Rates, and Market Sentiment

The funding rate is the core mechanism that keeps perpetual futures tethered to spot prices. At regular intervals-typically every eight hours-traders on one side of the market pay those on the other, depending on whether the perpetual contract is trading above or below the spot index. When the market is aggressively bullish and perpetual prices trade at a premium, long positions pay shorts; when sentiment is deeply bearish and the contract trades at a discount, shorts pay longs. This continuous rebalancing discourages persistent mispricing and aligns incentives across the market.

In practice, funding rates have become a real-time barometer of positioning and sentiment. Persistently elevated positive funding often signals crowded long exposure and increases the probability of a sharp correction and liquidation cascade, while sustained negative funding can precede short squeezes when marginal buyers step in. Analytics firms such as Glassnode, CoinGlass, and Kaiko now provide funding rate dashboards that institutional and professional traders monitor alongside volatility indices and order book depth. Readers interested in how AI and data analytics are transforming this monitoring process can explore TradeProfession's artificial intelligence coverage, where funding and liquidation analytics are increasingly discussed through the lens of machine learning and predictive modeling.

Margin Systems, Insurance Funds, and Auto-Deleveraging

Behind every leveraged position lies a risk engine designed to protect the exchange and the broader market. Margin systems typically operate in either cross-margin or isolated-margin mode. Cross-margin allows all available balance to support any open position, reducing the likelihood of immediate liquidation but increasing the risk that a single adverse move can impact the entire account. Isolated margin confines risk to a specific position, limiting losses but also reducing the buffer against volatility. Professional traders often mix both modes, using cross-margin for hedged portfolios and isolated margin for tactical or experimental trades. Readers can deepen their understanding of risk structuring and capital segmentation through TradeProfession's business strategy insights.

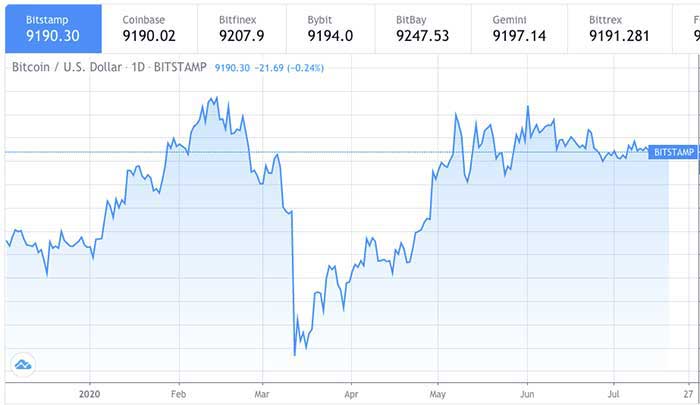

Insurance funds represent the next layer of protection. Leading exchanges maintain sizable reserves, funded by liquidation fees and other sources, to cover situations where positions are closed at a loss beyond the trader's margin. When market conditions are extreme and insurance funds are insufficient, auto-deleveraging (ADL) mechanisms may be triggered, reducing or closing profitable positions to offset systemic imbalances. Events such as the March 2020 crash, the 2022 Terra ecosystem collapse, and the 2024 altcoin deleveraging wave demonstrated how quickly these backstops can be tested. The presence of insurance funds and ADL frameworks is now a core due diligence criterion for institutional onboarding, alongside regulatory status and proof-of-reserves disclosures promoted by firms like Chainalysis and Nansen.

Regulation: From Tolerance to Structured Oversight

Regulatory treatment of crypto derivatives has advanced significantly by 2026. In the United States, the Commodity Futures Trading Commission (CFTC) continues to assert jurisdiction over Bitcoin and Ethereum futures, with regulated venues such as CME Group and LedgerX operating under stringent reporting, margin, and market surveillance rules. The approval of multiple Bitcoin and Ether futures ETFs by the U.S. Securities and Exchange Commission (SEC) has further normalized derivatives exposure within retirement accounts and institutional mandates, although leverage in these vehicles remains constrained compared to offshore exchanges. Professionals tracking these developments can follow ongoing policy evolution through organizations like FINRA and the U.S. Treasury's Financial Stability Oversight Council, complemented by market-focused coverage at TradeProfession's news section.

In Europe, the implementation of the Markets in Crypto-Assets (MiCA) framework and related national regulations has introduced harmonized standards for derivatives, custody, and leverage limits, with retail leverage often capped at 2x to 5x and higher tiers reserved for professional clients. Jurisdictions such as Germany, France, Italy, Spain, and the Netherlands now operate within a clearer regulatory perimeter, which has encouraged banks, brokers, and fintechs to offer structured crypto products with embedded risk controls. In Asia-Pacific, regulators in Singapore, Japan, Australia, and South Korea have adopted tiered models that balance innovation with consumer protection, often requiring explicit risk warnings, suitability checks, and leverage caps. This global convergence does not eliminate jurisdictional differences, but it signals a shift from permissive ambiguity to structured oversight, which in turn supports institutional confidence and cross-border capital flows.

DeFi Derivatives: On-Chain Leverage and Smart-Contract Risk

While centralized exchanges dominate volume, decentralized finance (DeFi) has developed its own ecosystem of leveraged products. Protocols such as dYdX, GMX, Synthetix, and newer entrants on Ethereum, Arbitrum, Optimism, Solana, and Avalanche enable users to trade perpetual futures directly from self-custodied wallets, with smart contracts handling margining, funding, and liquidation. This architecture offers transparency-positions, collateralization ratios, and liquidation events are visible on-chain-and composability, as derivatives positions can be integrated into broader DeFi strategies involving lending, staking, and liquidity provision.

However, DeFi derivatives introduce new risk vectors, including smart contract vulnerabilities, oracle manipulation, and network congestion that can delay liquidations or prevent timely collateral top-ups. Incidents such as the 2022 Mango Markets exploit and subsequent oracle-related attacks across multiple chains illustrated how adversarial actors can weaponize leverage and on-chain mechanics. Institutional participants exploring DeFi derivatives now demand rigorous audits, formal verification, and insurance arrangements from providers such as OpenZeppelin, Trail of Bits, and decentralized insurance protocols. The innovation cycle in this segment is rapid, and readers seeking to understand its implications for financial innovation can consult TradeProfession's innovation coverage, where DeFi is treated as a laboratory for the future of programmable finance.

Hedging, Risk Management, and Professional Discipline

The most sophisticated users of crypto futures in 2026 are not those seeking the highest leverage, but those treating derivatives as instruments for precision risk management. Hedge funds, proprietary trading firms, corporates, and family offices increasingly employ futures to hedge directional exposure, lock in basis spreads, or manage event risk around macroeconomic announcements, protocol upgrades, and regulatory decisions. For instance, a corporate treasury holding Bitcoin on its balance sheet may use short futures on CME or a regulated European venue to stabilize reported earnings against price volatility, while a global macro fund might deploy cross-asset hedges that link Bitcoin futures with equity volatility indices or FX pairs.

Risk management frameworks now integrate traditional metrics such as Value-at-Risk (VaR), stress testing, and scenario analysis with crypto-specific indicators like on-chain flows, funding rates, and liquidation heat maps. AI-driven systems monitor these inputs in real time, adjusting leverage, rebalancing hedges, or triggering de-risking protocols when volatility regimes shift. For executives and founders designing governance structures around treasury and trading activities, TradeProfession's executive insights and personal finance perspectives highlight how discipline, governance, and process can turn derivatives from a source of fragility into a source of resilience.

Data, Volatility, and the Anatomy of Liquidation Cascades

The relationship between volatility and liquidation events has become one of the most studied phenomena in crypto markets. Data from research firms such as The Block, CryptoQuant, and IntoTheBlock indicate that a large majority of liquidations cluster around periods of elevated realized and implied volatility, often triggered by macroeconomic releases from institutions like the Federal Reserve, geopolitical shocks, or protocol-specific news. When positions are crowded-such as during the February 2024 leverage cascade, where over 2.8 billion dollars in positions were liquidated in a single session-small price moves can breach critical liquidation thresholds, forcing exchanges to sell into a falling market or buy into a rising one.

This feedback loop is amplified by cross-exchange arbitrageurs and market makers who seek to keep prices aligned across venues. When one exchange's liquidation engine triggers, the resulting price move can propagate through others via algorithmic strategies, creating a synchronized wave of forced flows. Institutional traders now routinely monitor public liquidation maps and open interest distribution to identify zones where such cascades are likely. For professionals at tradeprofession.com, this data-driven approach aligns with a broader shift toward evidence-based decision-making across asset classes, a theme reinforced in the platform's coverage of global markets.

Human Behavior, AI, and the Future of Leverage

Despite the growing sophistication of tools and models, leverage trading remains deeply human. Behavioral biases such as overconfidence, loss aversion, and the temptation to "revenge trade" after a loss continue to drive many of the errors that result in liquidation. The democratization of derivatives access-through mobile apps, social trading platforms, and gamified interfaces-has made it easier than ever for individuals in the United States, United Kingdom, Germany, Canada, Australia, Brazil, South Africa, and beyond to engage with high-risk products without fully appreciating their dynamics. At the same time, institutional desks in Zurich, Singapore, and Tokyo are embedding behavioral training and psychological resilience programs into trader development, recognizing that emotional discipline is as critical as quantitative skill.

Artificial intelligence is increasingly deployed to counteract human bias, with risk engines and portfolio systems enforcing pre-defined loss limits, leverage caps, and de-risking triggers that cannot be overridden in the heat of the moment. Firms such as BlackRock, Goldman Sachs Digital Assets, and leading crypto-native managers are exploring AI-driven "co-pilots" that recommend or automatically implement risk adjustments based on real-time market conditions and historical patterns. However, AI does not remove responsibility; it shifts it toward system design, governance, and oversight. As tradeprofession.com continues to track the intersection of AI, markets, and professional practice, readers can expect deeper analysis of how these tools will redefine roles, skill sets, and organizational structures across the financial industry.

Toward a More Responsible Leverage Ecosystem

Looking ahead from 2026, the trajectory of crypto futures and leverage trading points toward a model of responsible innovation. Leading exchanges are implementing adaptive leverage limits that respond to volatility, enhanced disclosure of funding and liquidation statistics, and real-time proof-of-reserves to bolster trust. Regulators are moving toward harmonized standards for margin, reporting, and consumer protection, while industry associations and standard-setting bodies work on best practices for transparency and risk governance. Educational initiatives-from university programs in digital asset risk management to professional certifications focused on derivatives-are emerging across North America, Europe, Asia, and Africa, reflecting the recognition that knowledge is the most effective safeguard against misuse.

For the global audience of tradeprofession.com, spanning executives, founders, investors, and professionals from banking, technology, education, employment, and marketing, the message is clear: futures and leverage are no longer peripheral topics. They are central to understanding how digital assets interact with the broader economy, how capital is deployed, and how risk is transferred across regions and institutions. By combining rigorous analysis, disciplined processes, and an appreciation for both technological and human factors, market participants can harness the power of derivatives without becoming captive to their dangers.

Readers who wish to continue building this competence can explore the platform's dedicated sections on business and strategy, global markets, sustainable finance, the broader economy, and the evolving landscape of technology in finance. In a world where crypto derivatives are now embedded in global financial plumbing, the edge belongs to those who treat leverage not as a shortcut to returns, but as a sophisticated instrument that demands respect, expertise, and continuous learning.