Building Business Resilience in 2026: How TradeProfession's Audience Can Turn Volatility into Advantage

In 2026, leaders across industries are operating in a world where disruption is no longer an anomaly but a defining feature of the global business environment. Rapid advances in artificial intelligence, the restructuring of banking and capital markets, intensifying climate risks, shifting labor dynamics, and geopolitical fragmentation have all converged to create a landscape in which traditional planning cycles and static operating models are increasingly inadequate. For decision-makers who rely on TradeProfession.com for strategic insight across business, economy, technology, employment, investment, and global trends, the central question is no longer whether disruption will occur, but how consistently their organizations can absorb shocks, adapt, and emerge stronger.

Resilience, in this context, has evolved from a defensive concept focused on continuity into a proactive strategic capability that blends agility, technological sophistication, financial robustness, human capital development, and purpose-driven governance. Organizations that cultivate this capability are not simply better at surviving crises; they are better positioned to capture new opportunities in AI-driven innovation, digital finance, sustainable transformation, and cross-border collaboration. As the readership of TradeProfession spans founders, executives, investors, and policy influencers from North America, Europe, Asia-Pacific, Africa, and South America, the need for a globally informed yet practically grounded approach to resilience has never been more acute.

This article examines how resilient enterprises in 2026 are rethinking strategy and execution, drawing on cross-industry practices that align closely with the themes covered daily on TradeProfession's business insights. It explores the foundations of organizational agility, the role of advanced technologies, the integration of sustainability and ESG, the importance of workforce resilience, and the emergence of ecosystem-based strategies, while connecting these developments to concrete resources and perspectives that TradeProfession's audience can apply in their own contexts.

Strategic Agility as a Core Competence

The starting point for resilience is an operating model designed for continuous change rather than episodic transformation. Across the United States, Europe, and Asia, leading organizations have moved away from rigid hierarchies and multi-year static plans toward structures that emphasize empowered teams, rapid experimentation, and iterative strategy. Companies such as Amazon, Microsoft, and Salesforce have demonstrated that decentralized decision-making, supported by clear strategic intent and robust data infrastructure, allows them to respond faster to market shifts while maintaining coherence at scale.

The World Economic Forum continues to highlight adaptability and complex problem-solving as critical capabilities for both organizations and individuals, underscoring that agility is as much a cultural attribute as it is a structural one. Learn more about the evolving skills landscape and the future of work through resources available from the World Economic Forum. For TradeProfession's globally distributed readership, this means that resilience is not achieved by a single reorganization or cost-cutting program; it requires embedding learning loops into daily operations, where teams are encouraged to test new approaches, share insights across regions, and adjust course quickly when assumptions no longer hold.

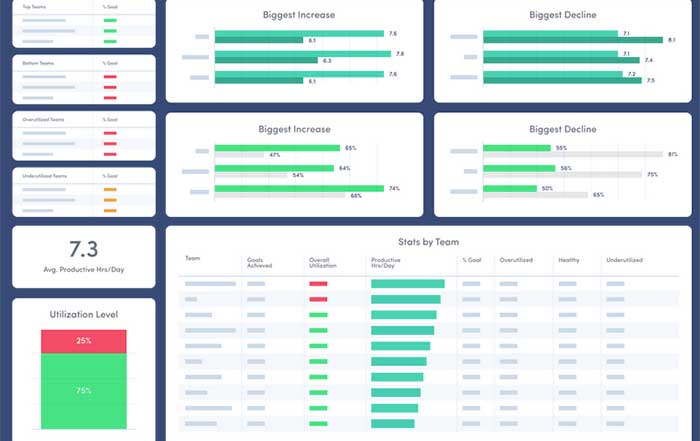

This agile mindset is increasingly being applied to macroeconomic and geopolitical risk as well. Executives following TradeProfession's economy coverage recognize that inflation cycles, interest rate shifts, and supply chain disruptions now unfold faster and with more interdependence than in previous decades. Resilient firms therefore align their strategic planning cadence with the speed of external change, updating scenarios quarterly or even monthly, and tying resource allocation to real-time performance and risk indicators rather than annual budgets alone.

Technology as an Engine of Resilience

By 2026, digital transformation has matured from a buzzword into a differentiator that separates resilient enterprises from those still struggling with legacy systems and fragmented data. The integration of artificial intelligence, advanced analytics, cloud-native infrastructure, and secure connectivity has become a prerequisite for operating in volatile markets, and this is a recurring theme within TradeProfession's technology section. Organizations that invested early in AI and automation are now using these capabilities to forecast demand with greater precision, optimize inventory, personalize customer engagement, and detect operational anomalies before they escalate into crises.

The applications of AI have expanded far beyond chatbots and recommendation engines. In manufacturing hubs in Germany, South Korea, and Japan, predictive maintenance powered by machine learning is reducing downtime and extending asset life. In financial centers such as New York, London, and Singapore, AI-driven risk models are reshaping credit assessment, fraud detection, and algorithmic trading, contributing to more resilient banking and capital market infrastructures. Readers can explore how digital finance is evolving in tandem with resilience strategies through TradeProfession's banking coverage and by engaging with insights from the Bank for International Settlements, which tracks technological innovation and systemic risk in global finance.

Cloud adoption has also become a cornerstone of resilience, enabling organizations from Canada to Australia and across emerging markets to scale capacity, support hybrid work models, and maintain continuity during localized disruptions. Providers such as Amazon Web Services, Microsoft Azure, and Google Cloud have invested heavily in multi-region architectures, disaster recovery capabilities, and advanced security, allowing enterprises to architect systems that can withstand regional outages or cyber incidents. Complementing this, edge computing and the Internet of Things are providing real-time visibility into operations, supply chains, and customer behavior, further enhancing the ability to respond swiftly to unexpected events.

For TradeProfession's audience focused on artificial intelligence, the dedicated AI hub offers practical perspectives on how organizations are using AI not only to drive efficiency but also to reinforce resilience in areas such as cybersecurity, compliance, and operational risk management.

Financial Resilience and Dynamic Risk Management

No resilience strategy is complete without a strong financial foundation. The volatility experienced in equity, bond, and crypto markets over the past several years has underscored the importance of disciplined balance sheet management, diversified revenue streams, and scenario-based financial planning. Organizations that maintained healthy liquidity buffers, avoided over-leverage, and diversified across geographies and sectors have been better positioned to navigate shocks ranging from pandemic-related downturns to regional conflicts and commodity price spikes.

Global advisory firms such as McKinsey & Company and Deloitte have continued to emphasize risk-adjusted value creation, encouraging boards and CFOs to evaluate investments through the lens of resilience as well as return. This includes stress-testing portfolios against multiple macroeconomic scenarios, assessing counterparty and supply chain exposures, and embedding risk analytics into everyday decision-making. The International Monetary Fund provides useful macroeconomic context and policy insights that can inform such analyses, accessible via the IMF website.

For investors and corporate finance professionals who follow TradeProfession's investment coverage and stock exchange developments, the lesson is clear: resilient capital allocation strategies favor optionality, flexibility, and transparency. This is evident in the way leading firms are balancing traditional financing with newer instruments such as sustainability-linked bonds, green loans, and tokenized assets, while also paying close attention to the regulatory evolution of crypto markets. Readers can deepen their understanding of digital asset regulation and systemic risk by exploring resources from the Financial Stability Board, which tracks global regulatory coordination.

In parallel, robust risk management frameworks now extend beyond financial metrics to encompass cyber risk, climate risk, and geopolitical risk, all of which have direct implications for enterprise value. Boards are increasingly integrating resilience metrics into executive compensation, recognizing that long-term performance depends on the ability to anticipate and absorb shocks rather than merely optimize for short-term earnings.

Workforce Resilience and the Human Dimension

Resilient organizations in 2026 recognize that technology and capital are only part of the equation; the adaptability, engagement, and well-being of the workforce are equally critical. The acceleration of remote and hybrid work, the impact of automation on job design, and the global competition for highly skilled talent have reshaped labor markets from the United States and United Kingdom to India, Brazil, and South Africa. Companies that invest in continuous learning, mental health, inclusion, and purpose-driven culture are finding that these investments pay off in higher retention, faster innovation, and more effective crisis response.

Leading employers such as Accenture, Unilever, and Siemens have built extensive reskilling and upskilling programs, partnering with universities and online platforms to help employees transition into roles that leverage AI, data science, and advanced manufacturing. The OECD has documented how such human capital investments contribute to productivity and resilience across economies, and its analyses on skills and labor markets can be explored through the OECD Skills portal. For executives and HR leaders following TradeProfession's employment and jobs insights, these examples underscore the importance of aligning talent strategies with long-term technological and market trends rather than reacting only when disruption is already underway.

Workforce resilience also depends on trust and psychological safety. During crises, employees look to leadership not only for clear direction but also for empathy and authenticity. Organizations that communicate transparently about challenges, involve employees in problem-solving, and provide support systems for mental health are better able to sustain performance under pressure. In Europe and parts of Asia, regulatory developments around employee well-being and right-to-disconnect policies are reinforcing this shift, and global frameworks such as those from the International Labour Organization provide additional guidance, accessible through the ILO website.

As TradeProfession continues to cover employment, education, and personal development themes, it is increasingly clear that workforce resilience is not a soft add-on but a core driver of organizational robustness and innovation capacity.

Sustainability, ESG, and Long-Term Value Creation

Environmental, Social, and Governance (ESG) considerations have moved from the periphery of corporate strategy to the center of resilience planning. Climate-related physical risks, such as extreme weather events, water stress, and biodiversity loss, are now recognized as material threats to supply chains, infrastructure, and communities across continents. At the same time, social expectations around equity, inclusion, and ethical conduct are shaping consumer behavior, regulatory action, and investor decisions in markets from the European Union to Southeast Asia.

Global leaders such as Microsoft, Patagonia, and Schneider Electric have demonstrated that integrating sustainability into core operations can strengthen resilience by reducing resource dependencies, opening new markets, and deepening stakeholder trust. Frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the emerging International Sustainability Standards Board (ISSB) standards are helping organizations standardize their ESG reporting and risk analysis; additional guidance can be explored through the IFRS Foundation.

For TradeProfession's readers focused on sustainable business models, the sustainability section provides a lens on how companies across industries are embedding climate and social considerations into strategy, governance, and product design. Complementary resources from the UN Global Compact and CDP offer case studies and benchmarks on corporate climate action and responsible supply chain management, helping organizations benchmark their progress.

In practice, sustainability-driven resilience often manifests through initiatives such as energy efficiency investments, circular economy business models, low-carbon logistics, and inclusive employment practices. These initiatives not only mitigate risk but also create new revenue streams and strengthen brand equity, particularly among younger consumers and employees for whom purpose and impact are central to decision-making.

Supply Chain Resilience and Regional Rebalancing

The disruptions of the early 2020s exposed the fragility of hyper-optimized, just-in-time global supply chains. Manufacturers and retailers from Germany to Mexico and from China to the Netherlands experienced delays and shortages that reverberated through entire industries. In response, resilient organizations are reconfiguring their supply networks to balance efficiency with robustness, often through a combination of regionalization, multi-sourcing, inventory buffers, and digital transparency.

Technologies such as blockchain, IoT sensors, and AI-based forecasting are enabling end-to-end visibility, allowing companies to track materials, monitor supplier performance, and simulate disruption scenarios in real time. Firms like Apple, Tesla, and Walmart have invested heavily in supply chain analytics and automation, enabling them to pivot sourcing and logistics routes quickly when disruptions arise. TradeProfession's readers can deepen their understanding of global trade dynamics and resilience strategies through the global business section and by consulting analysis from the World Trade Organization.

Regional policy initiatives, such as the European Union's emphasis on strategic autonomy in critical sectors and North America's reshoring incentives for semiconductor and clean energy manufacturing, are further accelerating supply chain rebalancing. The European Commission provides detailed policy and data resources on industrial strategy and supply chain resilience, which can be accessed via the European Commission's industry pages. For businesses operating across multiple regions, aligning corporate supply chain strategies with these policy trends is becoming an essential component of long-term resilience.

Cybersecurity, Digital Trust, and Operational Continuity

As organizations have digitized operations and embraced remote work, the attack surface for cyber threats has expanded dramatically. Ransomware, sophisticated phishing, supply chain attacks, and AI-generated disinformation campaigns have all become more prevalent, affecting companies of all sizes and across all regions. The cost of cyber incidents is not limited to direct financial losses; reputational damage, regulatory penalties, and operational downtime can be equally severe.

Resilient enterprises now treat cybersecurity as a board-level strategic issue rather than a purely technical concern. They invest in layered defenses, real-time threat intelligence, and incident response capabilities, often partnering with specialized providers such as CrowdStrike, Palo Alto Networks, and IBM Security. The European Union Agency for Cybersecurity (ENISA) offers valuable guidance on emerging threats and best practices, available at the ENISA website. For TradeProfession's audience tracking the intersection of technology, banking, and crypto, digital trust is a foundational enabler of innovation, particularly in areas such as decentralized finance, digital identity, and cross-border payments.

Beyond technology, cyber resilience depends on governance and culture. Regular training, clear policies on data handling and remote access, and simulations of cyber incidents help ensure that employees, contractors, and partners act as a line of defense rather than a point of vulnerability. Regulatory frameworks such as the EU's NIS2 Directive and various national cybersecurity strategies in countries like the United States, Japan, and Singapore are raising the bar for preparedness and reporting, further embedding cyber resilience into overall business resilience.

Scenario Planning, Foresight, and Strategic Governance

In an era where linear forecasts often fail, scenario planning and strategic foresight have become indispensable tools for resilient leadership. Pioneered by organizations such as Shell and refined by consulting firms including Deloitte and McKinsey, scenario thinking allows boards and executive teams to explore multiple plausible futures, test the robustness of their strategies, and identify early warning signals that might otherwise be overlooked.

Effective scenario planning in 2026 incorporates not only economic variables but also technological breakthroughs, climate trajectories, demographic shifts, and geopolitical realignments. Resources such as the World Economic Forum's Strategic Intelligence platform, accessible via intelligence.weforum.org, provide curated insights on interconnected global trends that can inform this work. For TradeProfession readers, integrating such foresight into corporate governance means moving beyond annual strategy retreats toward a continuous, data-informed dialogue about risk, opportunity, and resilience.

Boards are also strengthening their oversight of resilience by establishing dedicated risk and sustainability committees, incorporating external expertise, and aligning executive incentives with long-term value creation rather than short-term share price movements. This governance evolution is particularly evident in markets with active stewardship cultures, such as the United Kingdom, the Netherlands, and the Nordic countries, where institutional investors are increasingly vocal about resilience and ESG expectations.

Ecosystem Collaboration and the Power of Networks

Resilience is no longer solely an internal capability; it is increasingly shaped by the strength of an organization's external networks and partnerships. Public-private collaborations, industry consortia, and cross-border innovation hubs are playing a growing role in addressing systemic risks that no single company or government can manage alone, such as cyber threats, pandemic preparedness, climate adaptation, and critical infrastructure resilience.

Initiatives like the World Economic Forum's Resilience Consortium, the OECD's Business for Inclusive Growth platform, and regional innovation clusters in cities from Singapore to Toronto and Berlin illustrate how shared data, joint investment, and coordinated policy can amplify resilience. The OECD Resilience Dashboard provides a macro-level perspective on how economies are performing across multiple dimensions of resilience, accessible through the OECD resilience resources.

For the founders and executives who rely on TradeProfession's founders and executive sections, this ecosystem perspective translates into practical actions such as engaging in industry working groups, forming strategic alliances, participating in regulatory sandboxes, and contributing to shared standards. Small and medium-sized enterprises, in particular, can enhance their resilience by tapping into networks that provide access to capital, technology, talent, and market intelligence that would be difficult to develop alone.

From Insight to Action: TradeProfession's Role in the Resilience Journey

As 2026 unfolds, the organizations that will lead in AI, banking, business, crypto, sustainable innovation, and global expansion are those that treat resilience as a dynamic, organization-wide discipline rather than a static checklist. For the international audience of TradeProfession.com, resilience is not an abstract concept; it is the lens through which decisions about technology investment, market entry, talent strategy, capital allocation, and governance must now be made.

TradeProfession's integrated coverage across business, economy, technology, employment and jobs, banking and finance, crypto and digital assets, innovation, and sustainable strategy is designed to support this shift. By connecting developments across regions-from the United States and United Kingdom to Germany, Singapore, South Korea, and beyond-and across sectors, the platform enables leaders to see patterns earlier, benchmark their own resilience efforts, and learn from peers facing similar challenges in different contexts.

Resilient enterprises in 2026 are not defined by their immunity to disruption, but by their capacity to learn faster than the pace of change, to align technology and human capital with long-term purpose, and to collaborate across boundaries in pursuit of shared stability and growth. For readers of TradeProfession.com, the imperative is clear: resilience is no longer optional or peripheral; it is the central strategic capability that will determine which organizations not only endure the turbulence of this decade but also shape the opportunities that emerge from it.