Amazon in 2026: Inside a Global Engine of Commerce, Cloud, and AI

Amazon's Evolving Role in Global Business

By 2026, Amazon stands as one of the most complex and influential enterprises in global commerce, technology, and infrastructure. No longer simply a retailer, it operates as an integrated platform that spans consumer and business marketplaces, cloud computing, artificial intelligence, logistics, digital media, advertising, healthcare, and frontier technologies such as robotics and satellite networks. For the professional audience of TradeProfession.com, whose interests range from artificial intelligence and global business to sustainable operations, employment, investment, and innovation, Amazon offers a live case study in how a modern conglomerate can leverage data, technology, and scale to shape entire industries across North America, Europe, Asia, and beyond.

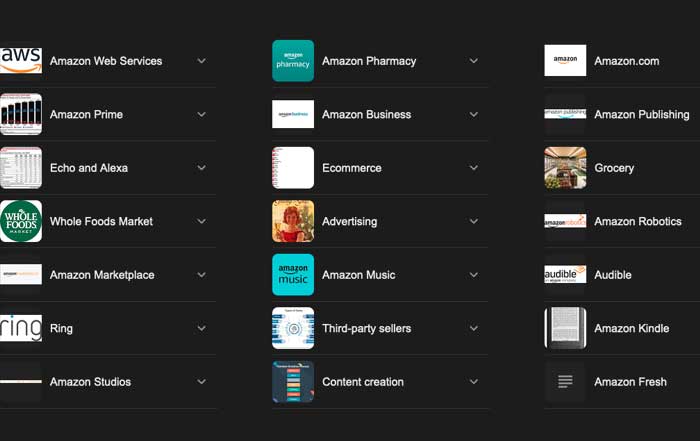

Amazon continues to articulate its mission in expansive terms-being "Earth's most customer-centric company" as well as a leading employer and a safe workplace-yet the practical realization of that mission now depends on orchestrating a portfolio of highly interdependent divisions. Revenue and profit are still reported through three main segments-North America, International, and Amazon Web Services (AWS)-but beneath this structure lies a lattice of business lines: online and physical retail, third-party marketplaces, subscription services, advertising, logistics and delivery, business-to-business commerce, healthcare, media and entertainment, devices and connected home, and an array of emerging bets in AI, space, and autonomous systems.

For executives, investors, founders, and policymakers, understanding Amazon in 2026 means looking beyond its retail storefront to examine how each division contributes to a broader architecture of data, infrastructure, and intelligence. It also requires assessing the risks that accompany this scale: regulatory scrutiny, labor and sustainability concerns, technological disruption, and the strategic tension between short-term profitability and long-term experimentation.

Readers who want to situate Amazon within broader macro trends can explore related insights on global business and economy and business strategy at TradeProfession.com, where Amazon frequently appears as a benchmark for platform scale, digital transformation, and cross-border expansion.

Retail and Marketplace: The Commercial Foundation

Online Retail as a Data-Rich Core

Online retail remains the public face of Amazon and the largest contributor to its revenue base. Across the United States, the United Kingdom, Germany, Canada, France, Italy, Spain, and markets such as Japan and Australia, Amazon's online storefronts anchor its ecosystem, offering vast assortments of goods, rapid delivery, and increasingly personalized experiences. Yet in 2026, the strategic role of online retail is less about simple gross merchandise volume and more about data, customer relationships, and the ability to fuel higher-margin businesses.

Amazon's online operations have become deeply intertwined with machine learning and generative AI. Product discovery, pricing, demand forecasting, and inventory placement are increasingly driven by algorithms that analyze real-time and historical signals at massive scale. The company's own AI tools, including generative assistants for merchants and internal "retail intelligence" systems, are designed to compress decision cycles and optimize margins in a low-margin environment. Professionals tracking the broader AI landscape can learn more about how such systems are reshaping commerce by examining developments in artificial intelligence and enterprise technology strategy.

In this context, the online retail division acts as both a profit center and a data engine: every search query, click, and purchase enhances Amazon's understanding of consumer behavior, which in turn powers recommendation engines, ad targeting, and product development. For markets such as the United States, United Kingdom, Germany, and Japan-where e-commerce penetration is mature-Amazon's challenge is no longer simple growth in user numbers, but deeper monetization, operational efficiency, and differentiation through speed, reliability, and personalization.

Physical Stores and Omnichannel Integration

While online commerce remains dominant, Amazon's physical footprint has become strategically important in key markets, particularly in North America and Western Europe. Whole Foods Market, Amazon Fresh, Amazon-branded convenience formats, and experimental store concepts act as both revenue generators and infrastructure nodes. They provide local inventory pools for same-day delivery, click-and-collect services, and convenient return locations, while also serving as brand touchpoints and testing grounds for in-store technologies such as computer vision checkout and smart carts.

In grocery, where competition from Walmart, Kroger, Tesco, Aldi, and regional players is intense, Amazon has continued to refine its private-label strategy and pricing architecture. The introduction and expansion of Amazon-branded grocery lines, designed to compete on value while feeding data back into its broader assortment strategy, reflects a deliberate attempt to secure share in a category that is high frequency but operationally challenging. Retail leaders can benchmark these strategies against broader trends in omnichannel retailing by reviewing analyses from organizations such as McKinsey & Company and Deloitte, which frequently highlight Amazon's approach as a reference point.

Physical stores, however, also expose Amazon to cost and regulatory pressures, particularly in markets like the European Union and the United Kingdom, where labor, zoning, and environmental rules are stringent. Balancing the benefits of local presence with the capital intensity of real estate and labor remains an ongoing strategic calculation.

Third-Party Sellers and the Marketplace Ecosystem

A defining feature of Amazon's retail architecture is its marketplace model, in which millions of third-party sellers from the United States, Europe, China, India, and other regions list products alongside Amazon's own retail offerings. This marketplace has become a critical driver of both selection and profitability, as seller fees, fulfillment services, and advertising generate high-margin revenue without the inventory risk borne by first-party retail.

Programs such as Fulfillment by Amazon (FBA) allow sellers to store goods in Amazon's warehouses and leverage its logistics network for pick, pack, and ship operations, while Seller Central tools provide analytics, pricing suggestions, and promotional options. Over time, Amazon has layered on additional services such as lending, brand protection, and cross-border trade support, particularly for sellers targeting markets like North America and Europe from Asia or Latin America. Those interested in how marketplaces shape global trade can explore broader implications on global business and trade.

Yet this ecosystem is also a source of persistent tension. Policy changes affecting reimbursement for damaged inventory, fee structures, or search ranking algorithms can materially impact seller profitability, particularly for small and medium-sized businesses in the United States, the United Kingdom, Germany, and emerging markets. Seller advocacy groups and regulators in regions such as the EU and India have raised concerns about self-preferencing, data use, and contractual fairness, leading to investigations and regulatory constraints. Organizations such as the European Commission and the U.S. Federal Trade Commission have intensified scrutiny of large platforms, with Amazon frequently at the center of these debates.

For Amazon, seller trust is both an asset and a vulnerability. Marketplace revenue is highly scalable and capital-light, but only if sellers see the platform as a viable, predictable, and fair channel for growth. Managing this relationship, while also competing directly as a retailer, is a delicate balancing act that will shape Amazon's reputation and regulatory exposure in the years ahead.

Amazon Web Services: Cloud, AI, and Enterprise Infrastructure

Amazon Web Services (AWS) remains the most profitable pillar of Amazon's portfolio and a central enabler of its broader ambitions. From data centers in North America and Europe to regions in Asia-Pacific, the Middle East, and South America, AWS provides compute, storage, databases, analytics, and a rapidly expanding suite of AI and machine learning services to organizations of all sizes. Governments, banks, manufacturers, startups, and digital-native platforms rely on AWS for mission-critical workloads, making it a systemic component of the global digital economy.

In 2026, AWS's strategic emphasis has shifted decisively toward AI, with a particular focus on generative and agentic systems. Building on its early releases of foundation models and AI development tools, AWS has consolidated offerings such as Amazon Q Business, QuickSight, and low-code AI application builders into integrated workspaces that aim to simplify how enterprises deploy AI in workflows, analytics, and customer engagement. Professionals tracking enterprise AI can deepen their understanding of these trends through resources from the World Economic Forum and the OECD AI Observatory.

Crucially, AWS serves not only external customers but also Amazon's own divisions. Retail, logistics, advertising, and media operations all run atop AWS infrastructure, benefiting from shared tools, security, and data platforms. This internal usage creates scale advantages in infrastructure investment and allows Amazon to test cutting-edge capabilities on its own businesses before commercializing them.

Competition, however, is intense. Microsoft Azure, Google Cloud, and regional providers in Europe and Asia are aggressively courting enterprises with differentiated AI offerings, industry-specific clouds, and hybrid architectures. Regulatory requirements around data sovereignty in regions such as the EU, the United Kingdom, and countries like Germany and France demand localized infrastructure and compliance frameworks. Organizations such as the European Union Agency for Cybersecurity and national data protection authorities increasingly influence how cloud services are architected and governed.

For Amazon, AWS's long-term success hinges on its ability to continue innovating in AI, security, and developer experience, while maintaining cost discipline and reliability at scale. The division's margins underpin Amazon's capacity to invest in less profitable or experimental areas, making AWS not just a business line but a financial engine for the entire enterprise.

Advertising: Monetizing Attention and Intent

Amazon's advertising business has quietly grown into one of its most powerful profit drivers. By monetizing shopper intent on its own properties and, increasingly, on external sites and devices, Amazon has built an ad platform that rivals the performance of traditional search and social media networks. Sponsored product listings, display ads, video ads on Prime Video and Twitch, and emerging formats on connected TV and voice interfaces all contribute to this high-margin revenue stream.

The strategic advantage lies in Amazon's access to transactional data. Unlike many digital platforms, Amazon can tie ad impressions directly to purchases, enabling precise attribution and optimization. Brands and agencies across North America, Europe, and Asia use Amazon's ad tools to reach consumers at the moment of purchase consideration, a capability that complements but also competes with platforms like Google and Meta. Marketers who want to understand how such performance ecosystems are reshaping budgets can review analyses from bodies like the Interactive Advertising Bureau and research from eMarketer / Insider Intelligence.

In recent years, Amazon has begun extending its advertising technology beyond its own marketplace, allowing retailers and publishers to deploy Amazon-powered ad solutions on their own sites and apps. This "infrastructure" approach mirrors AWS: rather than only serving ads on Amazon properties, the company aims to be a backbone for retail media and performance advertising more broadly. For professionals exploring the convergence of retail and marketing technology, the marketing and growth coverage at TradeProfession.com provides additional context on this shift.

Advertising also plays a vital role in Amazon's financial structure. As retail margins face pressure from inflation, logistics costs, and competition, ad revenue provides a buffer that can sustain investment in logistics, content, and frontier technologies. The key challenge will be managing regulatory demands for transparency, privacy protection, and competition, especially in jurisdictions with strict digital advertising rules such as the EU and the United Kingdom.

Subscriptions, Prime, and Customer Lock-In

Subscription services anchor Amazon's relationship with consumers and businesses, providing recurring revenue and deepening engagement. Amazon Prime remains the flagship program, bundling fast shipping, streaming video and music, reading benefits, gaming perks, and exclusive deals into a single membership. In markets such as the United States, the United Kingdom, Germany, and Japan, Prime penetration is high, making it one of the most influential subscription ecosystems in the world.

Beyond Prime, Amazon offers standalone subscriptions such as Kindle Unlimited, Audible, Amazon Music Unlimited, and specialized software and data services under AWS. Each subscription generates predictable cash flows and acts as a cross-selling platform for other Amazon products and services. For professionals examining how subscription economics shape modern business models, resources from Harvard Business Review and MIT Sloan Management Review offer frameworks that are directly applicable to Amazon's approach.

In 2026, Amazon faces a more crowded subscription landscape. Streaming competitors such as Netflix, Disney+, Apple TV+, and regional platforms in Europe and Asia have intensified the battle for consumer attention. Price sensitivity in markets affected by inflation, such as the United States and parts of Europe, has led to greater churn and scrutiny of subscription value. Amazon's response has involved adjusting pricing tiers, introducing ad-supported options in video, and layering in new benefits, including same-day delivery in more cities and exclusive content partnerships.

From a strategic perspective, subscriptions reduce Amazon's reliance on transactional retail revenue and create a durable moat around its ecosystem. However, they also require continuous investment in content, logistics, and product innovation to justify recurring fees in an environment where consumers can easily switch between services.

Devices, Voice, and the Connected Environment

Amazon's devices and services division, responsible for Echo, Alexa, Fire TV, Kindle, and an expanding array of smart home products, plays a hybrid role as both revenue source and ecosystem gateway. By embedding Alexa into speakers, televisions, vehicles, and appliances, Amazon aims to make voice a natural interface for search, entertainment, and shopping across North America, Europe, and markets like Japan and India.

In practice, the economics of hardware are often thin, and Amazon has periodically rationalized its device portfolio, discontinuing underperforming products and consolidating teams. The strategic value lies less in device margins and more in the data, engagement, and cross-selling potential that connected devices enable. Voice queries can feed into search and advertising; smart TVs can surface Prime Video and ad inventory; e-readers and tablets tie users into Kindle and app ecosystems.

The broader context for connected devices includes privacy regulation, competition from Apple, Google, and Asian manufacturers, and the rise of interoperable smart home standards such as Matter. Organizations like the Consumer Technology Association and standardization bodies track these developments closely. For Amazon, continued success depends on making Alexa and its devices indispensable interfaces in homes, cars, and workplaces, while addressing concerns about data usage, security, and long-term support.

Content, Media, and Entertainment Strategy

With the acquisition of MGM and the consolidation of Amazon MGM Studios, Amazon has firmly positioned itself as a media and entertainment player. Prime Video now competes head-on with global streaming leaders across the United States, Europe, Asia-Pacific, and Latin America, offering a mix of original series, films, sports rights, and licensed content. High-profile franchises, including control over the James Bond universe, provide marquee properties that can attract and retain subscribers.

Media serves multiple strategic purposes. It enhances the value proposition of Prime, supports advertising through ad-supported tiers and live events, and provides a platform for cross-promotion of retail products, games, and other services. For instance, integration of shoppable content and product placement allows Amazon to tie entertainment directly into commerce, an approach that aligns with broader trends in interactive and social shopping. Professionals examining the intersection of media, technology, and commerce can explore further through the news and analysis section of TradeProfession.com and external insights from organizations like PwC's Global Entertainment & Media Outlook.

However, content is capital-intensive and inherently hit-driven. Production costs, talent negotiations, and global distribution require significant investment, and success is never guaranteed. Amazon must weigh the brand and engagement benefits of tentpole content against the financial risks, especially as investors increasingly expect disciplined capital allocation from large technology companies.

Logistics, Fulfillment, and the Infrastructure Moat

Amazon's logistics network-spanning fulfillment centers, sortation hubs, delivery stations, air cargo, and last-mile fleets-remains one of its most formidable competitive advantages. In the United States, Canada, the United Kingdom, Germany, France, Italy, Spain, Japan, and an expanding set of markets, Amazon has built a vertically integrated delivery system that can achieve same-day or next-day delivery for a large share of orders.

This network supports not only Amazon's own retail operations but also third-party sellers via FBA and increasingly external clients who use Amazon for logistics services. The company's experimentation with Prime Air drones, autonomous delivery vehicles, and robotics-enhanced warehouses reflects a long-term strategy to reduce per-unit delivery costs, improve reliability, and address labor constraints. Those interested in the operational and technological dimensions of this infrastructure can find complementary perspectives on technology and operations and innovation in supply chains.

Sustainability has become a central concern in logistics. Amazon has publicly committed to ambitious climate targets, including net-zero carbon objectives, and is investing in electric delivery vehicles, renewable energy for facilities, and packaging reduction initiatives. Organizations such as the Science Based Targets initiative and the UN Global Compact provide frameworks that shape how large enterprises measure and report progress. For Amazon, aligning logistics growth with environmental commitments is essential to maintaining legitimacy with regulators, customers, and employees across Europe, North America, and increasingly climate-conscious markets like the Nordics and New Zealand.

Healthcare, Wellness, and Regulated Frontiers

Amazon's foray into healthcare has been gradual and experimental, reflecting the complexity and regulatory intensity of the sector. Through acquisitions such as PillPack and One Medical, Amazon has gained footholds in online pharmacy, primary care, and employer-focused health services in the United States. These offerings aim to combine digital interfaces with physical clinics and pharmacy logistics, leveraging Amazon's strengths in convenience, data, and fulfillment.

The company has also explored telehealth, prescription management, and health-related devices, though it has exited some initiatives that did not meet expectations. Structurally, Amazon has reorganized its health operations multiple times to improve focus and accountability, signaling that it is still iterating on the right operating model. Professionals following healthcare innovation can contextualize Amazon's moves alongside broader industry shifts documented by organizations like the World Health Organization and the U.S. Department of Health & Human Services.

Healthcare presents both opportunity and risk. Demographic trends in the United States, Europe, and parts of Asia, combined with rising demand for digital health solutions, create a vast addressable market. Yet clinical outcomes, patient privacy, data security, and regulatory compliance impose high barriers. Amazon's long-term presence in this space will depend on its ability to partner effectively with clinicians and institutions, respect regulatory boundaries, and demonstrate tangible improvements in access and outcomes.

Frontier Technologies: Robotics, Space, and Autonomous Systems

Beyond its core businesses, Amazon continues to invest in frontier technologies that may define the next decade of global infrastructure. Warehouse robotics, for example, has evolved from simple conveyor-based systems to advanced mobile robots and robotic arms capable of handling a broader range of items. These systems are tightly integrated with AI-driven optimization tools and computer vision, enabling higher throughput and safer working environments. The broader implications of automation for employment and skills are of particular interest to readers focused on jobs and employment and future-of-work trends.

In the realm of space, Project Kuiper aims to deploy a constellation of low Earth orbit satellites to deliver broadband connectivity to underserved regions across North America, South America, Europe, Africa, and Asia. If successful, Kuiper could complement AWS's edge computing strategy, support IoT and logistics operations in remote areas, and position Amazon as a key player in the global connectivity race alongside SpaceX's Starlink and other initiatives. Regulatory approvals from bodies such as the U.S. Federal Communications Commission and international spectrum authorities will be critical in shaping Kuiper's deployment.

Autonomous vehicle subsidiary Zoox is another long-horizon bet, focused on fully autonomous mobility services. While commercialization timelines remain uncertain, the underlying technologies in perception, planning, and control could have spillover effects into logistics, robotics, and safety systems across Amazon's operations.

These frontier projects are speculative and capital-intensive, but they reflect Amazon's enduring willingness to pursue long-term options that may redefine its role in global infrastructure and technology.

Regulation, Sustainability, and Societal Impact

As Amazon's reach has expanded, so has scrutiny from regulators, policymakers, labor organizations, and civil society. Antitrust investigations in the United States, the European Union, and markets such as the United Kingdom, India, and Brazil focus on marketplace practices, self-preferencing, data usage, and acquisitions. Privacy regulators examine how Amazon handles consumer data across devices, services, and advertising. Labor authorities and unions scrutinize working conditions in warehouses and delivery networks, particularly in Europe and North America.

At the same time, investors and stakeholders increasingly expect robust environmental, social, and governance (ESG) performance. Amazon's climate commitments, diversity and inclusion initiatives, and transparency on supply chain practices are closely watched by institutions aligned with frameworks such as the Task Force on Climate-related Financial Disclosures and the Global Reporting Initiative. Readers of TradeProfession.com interested in sustainable business can explore how these expectations are reshaping corporate strategy on the sustainable business section.

For Amazon, navigating this environment requires integrating compliance, ethics, and sustainability into the core of its operating model rather than treating them as peripheral concerns. The company's ability to maintain trust with consumers, employees, sellers, and regulators will be as important as its technological prowess in determining its long-term trajectory.

Implications for Business, Technology, and Investment Professionals

For the diverse audience of TradeProfession.com-spanning founders, executives, technologists, investors, and policy professionals across the United States, Europe, Asia, Africa, and the Americas-Amazon's evolution through 2026 offers several instructive themes.

First, Amazon demonstrates how a company can move beyond a single core business into a multi-division architecture where cloud, AI, logistics, and media reinforce one another. The interplay between AWS, advertising, and retail illustrates how high-margin infrastructure businesses can subsidize low-margin but strategically essential operations, a pattern relevant to leaders considering diversification and platform strategies. Those examining capital markets and valuation can connect these dynamics with broader trends in investment and stock markets and corporate finance.

Second, Amazon's aggressive adoption of AI across functions-from demand forecasting and warehouse robotics to generative tools for developers and business users-shows how artificial intelligence can move from isolated pilots to enterprise-wide capability. This transformation has direct implications for employment, requiring new skills in data science, prompt engineering, AI governance, and human-machine collaboration. The education and personal development content at TradeProfession.com explores how professionals can adapt to these shifts.

Third, Amazon's experiences in markets as varied as the United States, Germany, India, Brazil, and Japan highlight the importance of localization, regulatory engagement, and ecosystem partnerships. No single global template suffices; instead, Amazon has had to adapt its marketplace policies, logistics models, and product portfolios to local conditions, providing a useful reference for any company pursuing international expansion.

Finally, Amazon's trajectory underscores the necessity of balancing ambition with responsibility. Scale brings influence, but also obligations to workers, communities, and the planet. For business leaders charting their own strategies in technology, banking, crypto, or the broader economy, the Amazon case demonstrates that long-term success increasingly depends on integrating innovation, governance, and sustainability into a coherent whole.

As TradeProfession.com continues to analyze developments across technology, business, and global markets, Amazon will remain a central reference point-a living example of how a company can evolve from a focused digital retailer into a multifaceted infrastructure and intelligence platform that shapes commerce, work, and innovation across continents.