Leading E-Commerce Brands: How Digital Titans Redefine Global Trade

Right now global e-commerce has matured from a disruptive novelty into a foundational layer of the world economy, shaping how consumers in the United States, Europe, Asia, Africa, and the Americas discover, evaluate, purchase, and experience products and services. For the audience of TradeProfession.com, which spans decision-makers in Artificial Intelligence, Business, Banking, Crypto, Economy, Investment, Technology, and Global trade, the leading e-commerce brands are no longer just benchmarks of retail success; they are strategic case studies in how to build resilient, data-driven, and trustworthy digital ecosystems at scale.

As digital commerce extends across borders and devices, these brands have become reference architectures for executives, founders, investors, and policymakers. They illustrate how to orchestrate logistics, harness AI, navigate regulation, embed sustainability, and preserve consumer trust in an environment where competition is instantaneous and global. Within this context, TradeProfession.com positions itself as a platform where professionals can move from observation to execution, drawing on insights that connect e-commerce to adjacent domains such as innovation, technology, investment, and sustainable business.

The Strategic Significance of Leading E-Commerce Brands

The global e-commerce market in 2026 is estimated in the multi-trillion-dollar range, with online channels capturing an ever-greater share of retail and services across North America, Europe, and rapidly digitizing regions such as Southeast Asia, Latin America, and parts of Africa. Yet what distinguishes the top-tier e-commerce brands is not only their transaction volume; it is their ability to operate as multi-layered ecosystems that integrate cloud computing, logistics, payments, advertising, data analytics, and increasingly, AI-driven automation.

From a strategic perspective, leading e-commerce brands matter because they set the performance baseline for speed, reliability, personalization, and sustainability. Consumers in Germany, the United Kingdom, the United States, Singapore, and beyond now expect same-day or next-day delivery, transparent tracking, seamless returns, localized payment options, and consistent experiences across devices and channels. These expectations, forged by a handful of global leaders, cascade down the value chain and become implicit requirements even for mid-sized retailers and niche direct-to-consumer brands.

For readers of TradeProfession.com, understanding these leaders is not an academic exercise. Executives examining global economic trends can see how e-commerce platforms act as real-time barometers of demand. Founders building in Europe, Asia, or North America can study how platformization, marketplace models, and embedded financial services reduce barriers to entry. Investors can analyze how these brands manage margin compression, regulatory pressure, and technological disruption. Policymakers can observe how cross-border platforms intersect with national regulations on privacy, taxation, and competition. In each case, the leading brands provide a living laboratory for the future of digital trade.

The Global Vanguard: Platforms Shaping the Digital Marketplace

Amazon: The Archetype of Platform Power

In 2026, Amazon continues to operate as the archetypal e-commerce platform and a central reference point for global retail strategy. Its dominance is not rooted solely in the scale of its marketplace, but in the depth of its integrated infrastructure. Amazon Web Services (AWS) underpins thousands of digital businesses worldwide, embedding Amazon into the fabric of cloud-native commerce, fintech, media, and AI. Its fulfillment network, comprising robotics-enabled warehouses, regional distribution hubs, and sophisticated last-mile delivery, allows it to sustain rapid delivery standards across the United States, Europe, and increasingly in markets such as Japan and Australia.

Amazon's competitive advantage lies in its ability to treat e-commerce as one layer within a broader ecosystem that includes subscription services (Prime), media streaming, digital advertising, smart home devices, and B2B logistics services. This multidimensionality means that Amazon can cross-subsidize initiatives, experiment aggressively, and absorb regulatory or competitive shocks in one domain while maintaining strength in others. For professionals seeking to understand platform economics, a deep dive into Amazon's model illustrates how data, infrastructure, and recurring engagement combine to form a durable moat. Those exploring AI in commerce can also examine how Amazon uses machine learning for recommendation engines, demand forecasting, and supply chain optimization, aligned with broader trends in applied artificial intelligence.

Alibaba, AliExpress, and Lazada: China's Global Commerce Engine

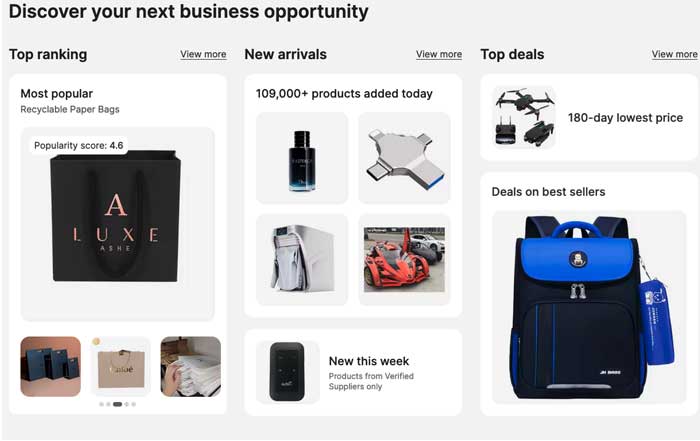

Across Asia and increasingly into Europe, Africa, and Latin America, Alibaba Group remains a central force in digital trade. Its portfolio of platforms, including Taobao, Tmall, AliExpress, and Lazada, demonstrates how a single corporate group can orchestrate domestic and cross-border commerce at massive scale. Alibaba's logistics arm, Cainiao, continues to push toward highly efficient cross-border and domestic delivery, leveraging data to optimize routing, warehouse placement, and customs clearance.

Unlike Amazon's more inventory-intensive model, Alibaba's core marketplaces function as enablement layers for merchants, allowing millions of small and mid-sized businesses across China and beyond to access global demand. This platform-centric design makes Alibaba particularly relevant to founders and exporters in regions such as Italy, Spain, and Brazil, who use cross-border marketplaces to reach consumers in Asia and Eastern Europe. The integration of payments through Alipay, and the growing emphasis on cloud infrastructure via Alibaba Cloud, show how commerce, fintech, and technology services can be woven together to support a multi-vertical digital economy. Professionals seeking context on cross-border trade dynamics can complement this understanding with resources from organizations such as the World Trade Organization and the World Bank.

Shopify: Infrastructure for the Independent Brand Economy

While marketplace giants capture headlines, Shopify has solidified its role as the infrastructure backbone for independent brands and direct-to-consumer ventures worldwide. By 2026, Shopify supports millions of merchants across North America, Europe, and Asia-Pacific, enabling them to build branded storefronts, integrate payment gateways, manage inventory, connect to logistics partners, and run multi-channel campaigns across social platforms and marketplaces.

Shopify's strategic significance lies in its philosophy of enablement rather than aggregation. Instead of competing directly with its merchants, it provides tools that allow them to control brand narrative, pricing, and customer relationships. Over the past few years, Shopify has accelerated its investment in AI-driven tools for personalization, marketing automation, and predictive analytics, helping smaller brands access capabilities once reserved for large enterprises. This aligns with broader industry trends in which AI democratizes sophisticated decision-making, a theme also explored in global research by organizations such as the OECD and McKinsey & Company.

For TradeProfession.com readers focused on founders, executive leadership, and marketing, Shopify's trajectory provides a blueprint for building scalable platforms that empower an ecosystem rather than centralize all value capture.

Mercado Libre: Latin America's Integrated Commerce and Fintech Powerhouse

In Latin America, Mercado Libre continues to function as both a marketplace and a financial infrastructure provider. Serving markets such as Brazil, Argentina, Mexico, Chile, and Colombia, the company has built a deeply integrated system that combines e-commerce, digital payments, credit, and logistics. Its fintech arm, Mercado Pago, has become a critical enabler of digital inclusion, providing payment solutions and credit access to consumers and small businesses that were historically underserved by traditional banks.

Mercado Libre's experience demonstrates how regional leaders can thrive by tailoring their models to local infrastructure constraints, regulatory environments, and consumer behavior. In markets where logistics networks and banking penetration have historically lagged those of North America and Western Europe, Mercado Libre has invested in its own delivery capabilities and financial products, rather than relying solely on third parties. For professionals examining banking and digital payments, this case illustrates how e-commerce, fintech, and logistics can converge to create a self-reinforcing growth engine in emerging markets, a trend also analyzed by institutions such as the International Monetary Fund and the Inter-American Development Bank.

Walmart and JD.com: Legacy Scale Meets Digital Reinvention

Traditional retail giants have not retreated in the face of digital disruption; instead, leaders such as Walmart and JD.com have reconfigured their assets to compete effectively in the e-commerce arena. In the United States, Walmart has leveraged its extensive physical store footprint as a network of micro-fulfillment centers, enabling same-day pickup and delivery for groceries and general merchandise. Its marketplace model, digital advertising platform, and investments in automation and data analytics have transformed it into a credible omnichannel competitor to Amazon.

In China, JD.com has distinguished itself through its emphasis on logistics excellence and product authenticity. Operating its own advanced warehouse and delivery network, JD.com has set benchmarks for same-day and next-day delivery in dense urban centers, as well as in more remote regions. Its deployment of drones, autonomous delivery vehicles, and AI-powered warehouse systems illustrates the frontier of logistics innovation, in line with broader technological trends discussed by organizations such as the World Economic Forum and MIT Technology Review.

Both Walmart and JD.com demonstrate how incumbent retailers can repurpose legacy assets-stores, supplier relationships, and brand recognition-into competitive advantages in the digital era, provided they invest in technology, data, and organizational transformation.

Temu and the Low-Cost Cross-Border Surge

In the last few years, Temu, backed by the Chinese group PDD Holdings (parent of Pinduoduo), has emerged as a disruptive force in international e-commerce. By connecting consumers directly to manufacturers, primarily in China, and emphasizing ultra-low prices, Temu has rapidly gained market share in the United States, parts of Europe, and selected Asia-Pacific markets. Its model reflects a high-intensity focus on supply chain efficiency, aggressive customer acquisition, and data-driven merchandising.

Temu's rise illustrates that despite advances in branding, experience design, and sustainability, price remains a powerful lever in many segments, especially in price-sensitive markets or categories. However, this approach also raises questions about quality control, sustainability, and regulatory compliance, issues that resonate with ongoing debates about responsible commerce and labor standards. Professionals seeking to understand the implications of such models can contextualize them with research from bodies such as the International Labour Organization and the United Nations Conference on Trade and Development.

Core Strategic Pillars of E-Commerce Leadership

Logistics and Fulfillment as Strategic Infrastructure

While e-commerce appears digital on the surface, its competitive foundation is profoundly physical. The ability to move goods efficiently from factories and warehouses to consumers is a decisive differentiator. Leaders such as Amazon, JD.com, Walmart, and Mercado Libre have invested heavily in warehouse automation, route optimization, last-mile partnerships, and reverse logistics to handle returns and refurbishments.

For businesses at any scale, the lesson is that logistics cannot be treated as a back-office function; it is a core component of brand promise. Delays, stock-outs, and poor return experiences erode trust and drive customers to competitors. Conversely, reliable and transparent fulfillment builds loyalty and unlocks opportunities for value-added services such as subscriptions, same-day delivery tiers, and premium packaging. Professionals evaluating supply chain strategies can deepen their understanding through resources offered by the Council of Supply Chain Management Professionals and the Institute for Supply Management.

Data, AI, and the Emergence of Agentic Commerce

Data has become the lifeblood of leading e-commerce brands. Every interaction-search queries, clicks, purchases, reviews, returns-feeds machine learning systems that optimize everything from pricing and inventory allocation to marketing campaigns and fraud detection. Amazon, Alibaba, Shopify, and JD.com have each built extensive data infrastructures that allow them to forecast demand, personalize recommendations, and automate operational decisions at scale.

An emerging development in 2026 is the rise of "agentic commerce," in which AI agents act on behalf of consumers to discover products, compare options, and even complete purchases autonomously within predefined parameters. As AI assistants become more capable and integrated into operating systems, browsers, and messaging platforms, consumer journeys may increasingly bypass traditional search and browsing patterns. Brands and platforms will need to expose structured data and APIs that allow these agents to interact with inventories, pricing, and promotions. For TradeProfession.com readers exploring the intersection of AI and commerce, this shift underscores the importance of engaging with both technical and strategic dimensions of artificial intelligence in business, as well as staying informed about evolving AI governance frameworks from entities such as the European Commission and the National Institute of Standards and Technology.

Brand Equity, Trust, and Consumer Protection

In a landscape where consumers can switch platforms with a few clicks or taps, trust becomes a critical form of capital. Leading e-commerce platforms invest significantly in fraud prevention, product authenticity verification, buyer and seller protection programs, and transparent dispute resolution. Amazon's A-to-Z Guarantee, Alibaba's escrow mechanisms, and Mercado Libre's trust badges and guarantees are all designed to reduce perceived risk and encourage repeat transactions.

Trust extends beyond transactional security to encompass data privacy, responsible use of AI, and responsiveness to consumer complaints. Regulatory frameworks such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) have raised the bar for data handling, while emerging AI regulations in the European Union, the United States, and Asia are beginning to define expectations around transparency and accountability. Professionals can track these developments through resources provided by authorities such as the European Data Protection Board and the U.S. Federal Trade Commission.

Ecosystem Extension and Revenue Diversification

One of the defining characteristics of top e-commerce brands is their ability to move beyond pure retail margins into higher-value services. Amazon generates substantial revenue from AWS and digital advertising; Alibaba and JD.com monetize cloud services, logistics, and financial products; Mercado Libre benefits from payments and credit; Walmart is growing its digital advertising and marketplace services. This diversification provides resilience against fluctuations in consumer spending and competitive pricing pressure.

For executives and investors, the lesson is that e-commerce can be an entry point to broader ecosystems encompassing payments, media, software, and data services. The capacity to evolve from a single revenue stream to a multi-layered portfolio is a hallmark of long-term competitiveness. Readers interested in the financial and strategic implications of such models can align these insights with broader business and investment perspectives shared across TradeProfession.com.

Global Scale with Local Sensitivity

Operating across multiple countries and regions requires a delicate balance between global standardization and local adaptation. Leading platforms localize language, user interfaces, payment methods, and logistics strategies to meet the expectations of consumers in markets as diverse as the United Kingdom, France, India, South Korea, South Africa, and Brazil. They also navigate complex regulatory regimes related to taxation, customs, consumer protection, and data sovereignty.

Success in this domain demands deep local partnerships, flexible technology architectures, and robust compliance frameworks. For example, cross-border sellers leveraging AliExpress, Amazon Global, or Shopee must understand customs rules, VAT requirements, and product standards in each target market. Organizations such as the World Customs Organization and the International Chamber of Commerce provide guidance on these topics, complementing the practical insights available in global trade coverage on TradeProfession.com.

Sustainability, Ethics, and Social Responsibility

As environmental and social concerns gain prominence across Europe, North America, and Asia-Pacific, leading e-commerce brands face growing expectations to reduce their ecological footprint and improve supply chain transparency. Companies such as Amazon, Alibaba, and Walmart have announced climate pledges, investments in renewable energy, and initiatives to reduce packaging waste. Consumers and regulators increasingly scrutinize carbon emissions associated with rapid delivery, labor conditions in warehouses and delivery networks, and the lifecycle impact of products.

E-commerce leaders that treat sustainability as a strategic pillar rather than a peripheral initiative can differentiate themselves with carbon-neutral shipping options, circular economy programs such as trade-ins and refurbishments, and transparent reporting aligned with frameworks like the Task Force on Climate-related Financial Disclosures. For TradeProfession.com readers, this intersects directly with themes explored in sustainable business content, highlighting how environmental performance and long-term value creation are increasingly intertwined.

Lessons from Course Corrections and Niche Innovators

The evolution of e-commerce leadership is not linear; it is marked by experimentation, missteps, and strategic recalibrations. Direct-to-consumer brands that expanded aggressively into physical retail during the early 2020s, such as Parachute Home, discovered that brick-and-mortar growth without sufficient brand awareness and operational discipline can strain resources and dilute focus. Parachute's decision to scale back its store footprint and refocus on e-commerce and targeted wholesale partnerships serves as a cautionary example for founders tempted to equate physical expansion with brand maturity.

At the same time, niche leaders such as Bellroy, Summersalt, and Lookiero have demonstrated that carefully defined positioning, strong community engagement, and operational excellence can yield significant success without immediate mega-scale. These brands often excel in social commerce, content-driven marketing, and direct customer relationships, using platforms like Shopify and targeted marketplace presence to maintain control over their identity and margins. Their experiences resonate with many TradeProfession.com readers building careers and companies in jobs and employment, personal development, and entrepreneurial ventures across Europe, North America, and Asia.

Strategic Takeaways for TradeProfession.com's Professional Audience

For the business, technology, and policy professionals who rely on TradeProfession.com as a trusted resource, the trajectories of leading e-commerce brands in 2026 crystallize several strategic imperatives. Logistics and fulfillment must be treated as core differentiators, not as commoditized back-end functions. Data and AI capabilities should be embedded into every layer of the organization, from merchandising and pricing to customer service and fraud prevention. Brand and trust require continuous investment, supported by transparent policies, robust consumer protections, and responsible data practices.

Moreover, executives should recognize the importance of ecosystem thinking. Whether through building marketplaces, offering embedded financial services, or providing software and data solutions to partners, the most resilient e-commerce companies are those that create value webs rather than linear value chains. Global ambitions must be matched with local expertise, regulatory fluency, and cultural sensitivity. Sustainability and social responsibility are no longer optional add-ons; they are increasingly central to risk management, regulatory compliance, and consumer loyalty.

Above all, adaptability remains the defining trait of long-term winners. As agentic commerce, immersive experiences, and on-demand manufacturing evolve, the ability to experiment, learn, and pivot will distinguish those who merely participate in e-commerce from those who shape its future.

Positioning TradeProfession.com at the Intersection of Commerce, Technology, and Global Strategy

For professionals tracking these developments, TradeProfession.com serves as a bridge between high-level trends and actionable insight. By integrating perspectives across technology, economy, investment, business leadership, and innovation, the platform offers a vantage point from which readers can interpret the moves of global e-commerce leaders and translate them into their own strategic roadmaps.

As e-commerce continues to reshape how goods and services move across borders, the lessons drawn from Amazon, Alibaba, Shopify, Mercado Libre, Walmart, JD.com, Temu, and a growing cohort of niche innovators will remain highly relevant to decision-makers in the United States, the United Kingdom, Germany, Canada, Australia, France, Italy, Spain, the Netherlands, Switzerland, China, Sweden, Norway, Singapore, Denmark, South Korea, Japan, Thailand, Finland, South Africa, Brazil, Malaysia, and New Zealand. For this global audience, the challenge is not merely to keep pace with these leaders, but to internalize the principles that underpin their success-rigorous execution, intelligent use of technology, disciplined expansion, and unwavering commitment to trust-and apply them in ways that reflect the unique realities of their own markets and organizations.

In doing so, the professionals who engage with TradeProfession.com are not just observers of digital commerce; they become active participants in shaping the next chapter of global trade.